Are you getting sick of racking up your paychecks before the month is over? We get it—adulting is tough! But managing your income doesn’t have to be rocket science. However, you do need to start with the hardest part first. Getting or keeping your finances on track means being honest with yourself and staying consistent. But to become consistent, especially when you are not very disciplined with other things in your life or if you have ADHD, you need to start small and make it ‘fun’ for you. Having money and ticking your money goals is extremely rewarding. Still, let’s face it, many ways to budget don’t work for everyone. They’re mostly a one-size-fits-all solution. To turn budgeting into a habit, like exercise or eating well, takes time and using the right tools. That’s why we’re offering not just one, but five budget trackers to kick-start your financial journey. With easy-to-follow steps, these trackers will give you the transparency and consistency you need, and make budgeting more fun when you start reaching your goals.

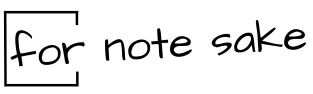

The Spending Triggers Tracker

It’s time to do the hard part and start looking closely at your daily spending habits. When you understand your emotional or situational triggers that lead to an impulse buy, you will identify patterns and stop a trigger before making a purchase that will end up unused or stuck in a drawer. A spending triggers tracker will help you save money and free up valuable space at home.

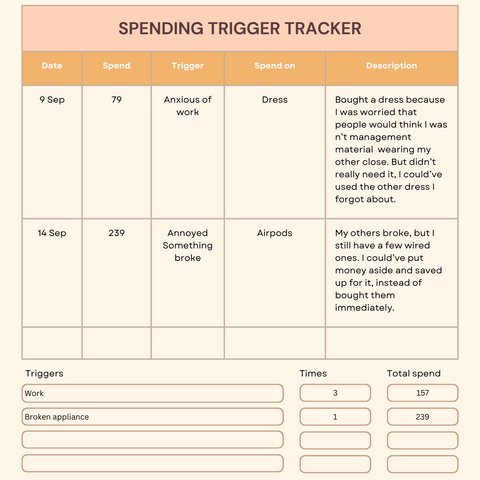

The 50-30-20 Budget Tracker

Have you heard of the 50-30-20 budget rule yet? It is a way to manage and budget your income using three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. Here’s an example of setting up this tracker in your journal. Mixing the description with spending triggers will make it easier to manage that 30% of wants and not exceed it.

Two-Week Waiting Period Template

Still touching your 20% of savings too fast, too soon? Perhaps it’s worth trying out the Two-Week Waiting Period Tracker. Giving yourself two weeks of breathing space can be a game-changer when it comes to shopping. It’s like a pause button that gives you time to decide if you really need to add that new item to your collection or if it’s just a craving that will pass. It also has a few other benefits. For one, it allows you to research the item further, see if the product fits your needs, or check out better deals. It will also help you build financial discipline, protect your spending habits, and give you time to evaluate whether that item you want to buy fits your 50-30-20 rule. If it does fit your 30-20% rule, it might teach you how to save up for it instead of buying it impulsively.

Savings Goal Flow

So how about those savings? Do you want to save up regularly or have a specific savings goal? Then, it’s best to keep your monthly budget or potential (seasonal) overspend in mind and dot it down in your budget tracker. Don’t try to save the same amount each month. You might have an extra birthday or electricity bill come in. By adding these special expenses to your tracker each month, your budget becomes more transparent and controllable. Focus on the end goal, then calculate how much money you need to save each month by considering additional bills. See the example below.

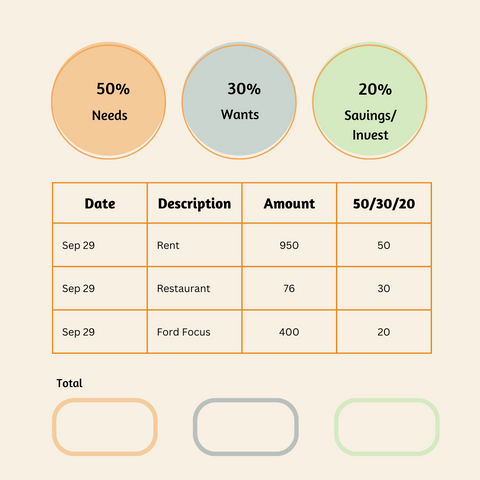

Emergency Funds Tracker

Remember the 50% in the 50-30-20 budget method? You should keep an emergency fund for 50% of your needs. Every so often, a bill might come out higher than expected. Think about a car’s yearly check-up, changing your tires, the lifespan of your fridge, washing machine, or PC. By adding an emergency fund separate from your regular savings, you’ll always have money at hand when things might get a little tight.

A few good journaling prompts to help you budget each year or month.

These prompts are a great addition to your bullet journal or calendar. Do you keep a digital calendar? Schedule some time to answer these each week or month. That will keep the routine going!

Budget prompt 1:

Which financial decisions (last year or last month) have paid off, and which decisions have cost me more in the long run?

Budget prompt 2:

What valuable lesson have I learned from past financial challenges?

Budget prompt 3:

Which financial pleasures have brought me joy? And how did these enhance my quality of life?